This is the first blog in a new monthly series exploring CityHealth’s 2.0 policy package. Sign up for our newsletter to learn about new policy solutions, tools, and resources.

In cities across America, access to safe, affordable housing consistently ranks among the most pressing concerns for residents. It’s easy to understand why; having a home is foundational to living a healthy, full life. Yet as housing prices have reached historic highs and rental costs have risen dramatically since the start of the COVID-19 pandemic, access to affordable housing is out of reach for millions of residents — with profound implications for people’s health and well-being.

Earlier this year, CityHealth announced a new, 2.0 package of policy solutions that will help cities provide residents with access to a safe place to live, a healthy body and mind, and a thriving environment. The new package includes three new policies that form the basis of our housing policy platform:

This month, we’re kicking off a blog series that explores the new policy package with a look at Affordable Housing Trusts. Affordable Housing Trusts are a community-driven way for cities to invest in building and maintaining affordable housing for everyone. They can also make our communities more inclusive by ensuring that all people — no matter their income — have access to affordable housing.

The Affordable Housing Challenge

For low-income families, communities of color, and vulnerable populations, the housing crisis is particularly dire. A Harvard University study found that one in four renters — or about 11 million people — spend more than 50% of their income on housing. After paying rent, these families often have few resources left for necessities like food, transportation, and healthcare — and for many, a single financial setback can lead to eviction or homelessness.

Over the past century, racially motivated housing policies have adversely affected communities of color, leading to persistent place-based racial and health disparities. Structural inequities that resulted from discriminatory housing policies — such as restrictive covenants, redlining, blight and appraisal guidelines, and exclusionary zoning — continue to impact housing affordability, quality and safety, stability, and neighborhood conditions in cities today.

The solution is clear: cities need more affordable housing. The National Low-Income Housing Coalition estimates that at least 7.2 million affordable and available housing units are needed for extremely low-income people. Fortunately, equitable policy solutions like Affordable Housing Trusts have been proven to help residents access high-quality, affordable homes and can reduce exposure to unhealthy living environments, lessen the cost burden of housing, and enhance housing and neighborhood stability.

A Tried and Tested Solution

The goal of Affordable Housing Trusts is straightforward: create a trust fund from public revenue that can be used in a variety of ways to create and sustain affordable housing. For city leaders, Affordable Housing Trusts can be an appealing solution because trusts provide a dependable source of affordable housing funding, can promote equity, can leverage other funding sources, and provide flexibility to meet local needs and priorities.

Affordable Housing Trusts are widely used by both state and local jurisdictions. According to the National League of Cities, 33 states and the District of Columbia have both state and local housing trusts, and the Housing Trust Fund Project estimates that there are a total of 600 city housing trusts in operation today. Cities often finance housing trusts through local real estate activity and property taxes, but they also can be financed through a variety of mechanisms — including tax increment finance districts (Atlanta), surcharges on short-term rentals (Oakland), or state or local bonds (Minneapolis).

Housing trusts can be dispersed in a variety of ways to meet local needs and promote equity. Grants or loans can go to a range of awardees, including homebuyers, renters, landlords, local housing authorities, and developers. They can also advance special priorities by assigning higher values to applications for particular populations or places (such as residents with the lowest incomes) or can dedicate a portion of funds for a specific set of activities such as housing for the elderly or those with special needs.

The impacts of Affordable Housing Trusts can be far-reaching and can vary with the design of each program. By providing more people with affordable housing and preserving long-term affordability, housing trusts can help negate poor health outcomes associated with housing costs, quality, stability, and neighborhood context, which are much more likely to affect people of color and low-income and vulnerable populations. They have also been shown to be highly effective in leveraging outside funding for affordable housing; in 2016-2017, Philadelphia successfully leveraged $14 million in non-city funding with just $3 million from its housing trust.

A Look at St. Louis’ Affordable Housing Trust

St. Louis’ affordable housing trust has directly financed the construction of 1,954 affordable housing units.

In 2003, St. Louis established an Affordable Housing Trust to award loans and grants to develop affordable housing projects and provide housing-related services, including rental/utility assistance, accessibility modifications, home repair, and support for people experiencing homelessness. To date, the trust has invested nearly $33 million, which has directly financed the construction of 1,954 affordable housing units.

St. Louis’ housing trust funding comes from a city use tax paid by businesses on out-of-state purchases. By ordinance, all disbursements must benefit families and individuals with incomes at or below 80% of the area’s established median income. The fund goes further to target very low incomes, with a requirement that 40% of its funds must benefit families and individuals with incomes at or below 20% of the area’s established median income.

The city’s trust has had remarkable success leveraging outside investment. Since 2003, trust fund projects have invested an additional $650 million into housing projects in the community, financing more than 3,821 homes. Remarkably, every trust fund dollar invested in home construction attracts $18.77 from non-city public and private sources.

Earning CityHealth Gold: Affordable Housing Trusts

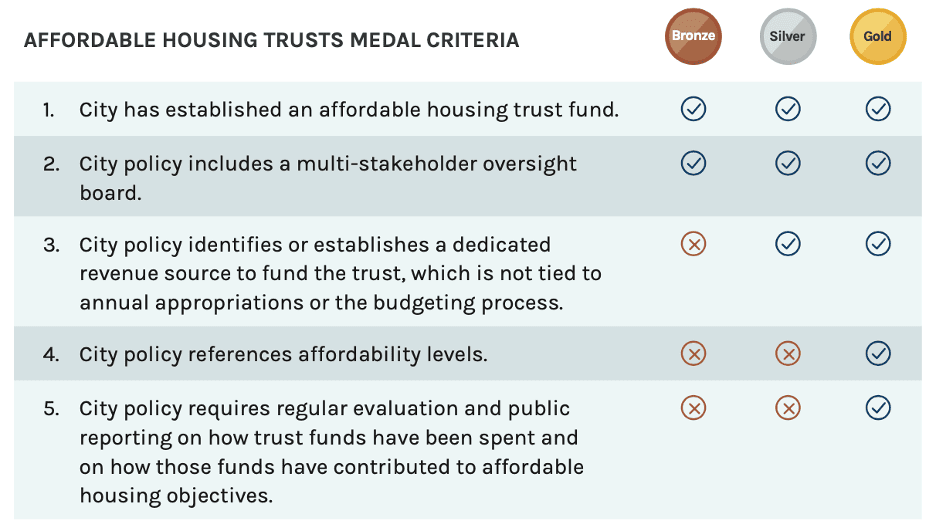

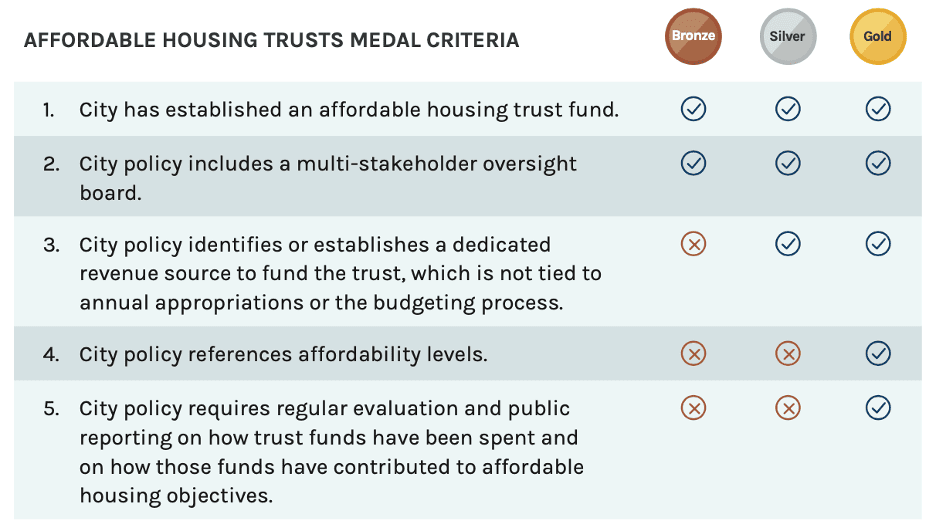

Starting in 2022, CityHealth will assess the nation’s largest 75 cities on their Affordable Housing Trusts policies. Cities can earn a gold, silver, or bronze medal based on how the city performs on five key criteria:

CityHealth is a resource for city leaders, policymakers, and advocates pursuing policy change that can help all residents live healthy, full lives. Have a question about Affordable Housing Trusts or any of our other policies? Please feel free to send us an email, and join us to learn more about the tools, research, and technical assistance opportunities from CityHealth and our partners.